Estimated reading time: 6 minutes

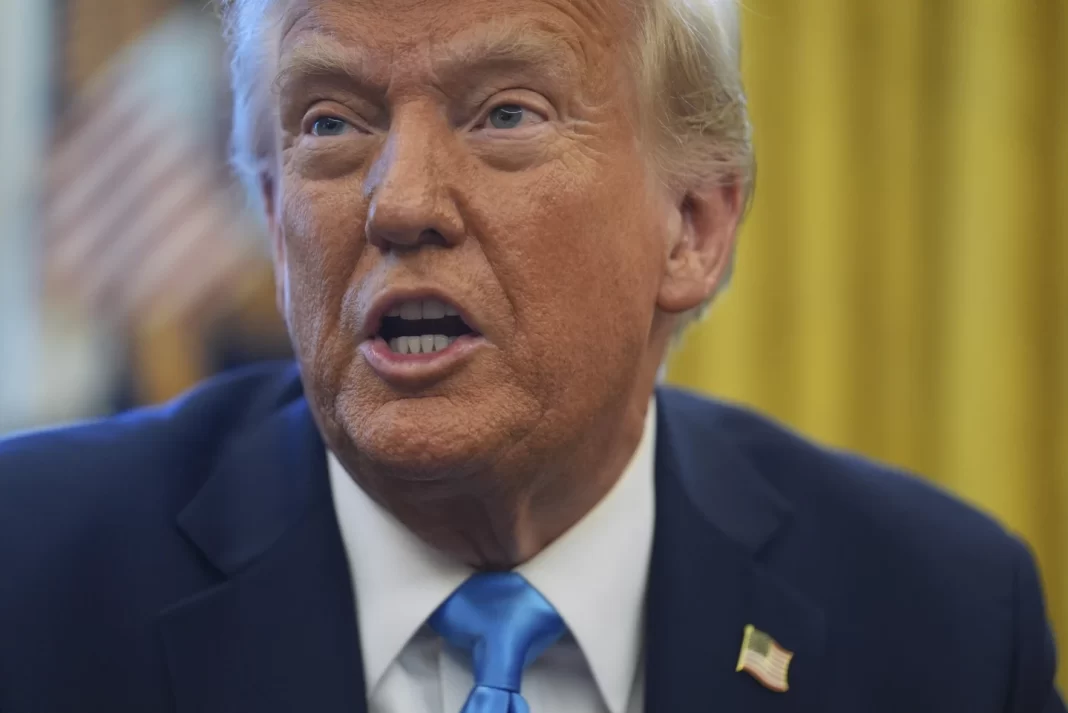

When Donald Trump started the biggest trade war since the 1930s in his first term, his impulsive combination of threats and import taxes on U.S. trading partners created chaos, generated drama — and drew criticism from mainstream economists who favor free trade.

But it didn’t do much damage to the U.S. economy. Or much good. Inflation stayed under control. The economy kept growing as it had before. And America’s massive trade deficits, the main target of Trump’s ire, proved resistant to his rhetoric and his tariffs: Already big, they got bigger.

The trade war sequel that Trump has introduced in his second term is likely to be a different matter altogether. Trump appears to have grander ambitions and is operating in a far more treacherous economic environment this time.

His plans to plaster tariffs of 25% on goods from Mexico and Canada and to double a 10% levy on China Tuesday – and to follow those up by targeting other countries – would threaten growth, and push up prices in the United States, undermining his campaign pledge to eliminate the inflation that plagued President Joe Biden.

The tariffs would be paid by U.S. importers, who would then try to pass along the higher costs to consumers through higher prices.

Trump himself has warned of possible fallout. “WILL THERE BE SOME PAIN? YES, MAYBE (AND MAYBE NOT!),” Trump said in a social media post last month. “BUT WE WILL MAKE AMERICA GREAT AGAIN, AND IT WILL ALL BE WORTH THE PRICE THAT MUST BE PAID.”

For a while, most of the hostilities were on hold. Trump, who had said he would hit Canada and Mexico on Feb. 4, delayed imposing the tariffs for 30 days. Now they’re scheduled to start Tuesday. He went ahead with 10% import taxes on Chinese goods — and Beijing promptly retaliated by hitting U.S. coal, big cars and other items — and plans to double them Tuesday.

Trump views tariffs – taxes on imports – as an economic elixir that can restore factories to the American heartland, raise money for the government and pressure foreign countries to do what he wants.

During his first term, Trump put tariffs on most Chinese goods and on imported solar panels, washing machines, steel and aluminum. The tax increases might have raised prices on those items, but they had little or no impact on overall inflation, which remained modest. Nor did they do much to restore factory jobs.

Economists agree that a second Trump trade war could be far costlier than the first.

“That was then. This is now,’’ said trade analyst William Reinsch of the Center for Strategic and International Studies.

During Trump’s first term, his trade team carefully focused its tariff hit list to avoid or at least delay the impact on consumers. They targeted industrial products and not those “that would show up on Walmart’s shelves,” said Reinsch, a former U.S. trade official. “That tamped down the impact.’’

This time, by contrast, the tariffs are across the board – although the tariffs Trump plans Tuesday would limit the levy on Canadian energy to 10%, showing that he was mindful of how much Americans in northern and midwestern states depend on oil and electricity from north of the border.

In Boca Raton, Florida, the toy company Basic Fun is preparing to raise prices and absorb a hit to profits when the tariffs land.

Ninety percent of Basic Fun’s toys come from China, including Tonka and Care Bears. CEO Jay Foreman says the price on the Tonka Classic Steel Mighty Dump Truck is likely to rise later this year from $29.99 to as much as $39.99.

Five years ago, the Trump administration spared toys, exempting them from its China tariffs. This time, Foreman said, “we are now just going to forecast a lot of money draining out of the company.’’

Also worrying, economists say, is a retaliation clause the Trump team inserted in the tariff orders he signed last month.

If other countries retaliate against Trump’s tariffs with tariffs of their own – as China did and Canada and Mexico have threatened — Trump will lash back with still more tariffs. That risks “setting off a spiraling trade war’’ of tit-for-tat tariffs and counter-tariffs, said Eswar Prasad, professor of trade policy at Cornell University.

Economists gathered Monday at a conference of the National Association for Business Economics were generally wary of the import taxes and their impact on the economy. Michael Strain, an economist at the conservative American Enterprise Institute, estimated that the proposed duties could drag down economic growth by as much as a half-percentage point.

One big difference between Trump’s first term is that he’s likely to get less pushback from his own aides. “This is true religion inside the White House right now, unlike the first term, when many of the president’s advisers were deeply skeptical of this policy,” Strain said.

Diane Swonk, chief economist at the giant accounting firm KPMG, said the impact of tariffs this time would likely be much bigger than in 2018-2019. Among other things, the president is planning to impose what he calls “reciprocal tariffs’’ — and raise U.S. import taxes to match higher tariffs charged by other countries.

Advertisement

“The breadth and scope are different,” Swonk said. “The goals are different. It’s not just one country, we’re talking about multiple countries at the same time. And the rest of the world is ready to retaliate.”

One of those goals that Trump has cited more often than last time is using tariffs to raise revenue for the government, Swonk noted. Trump and some of his officials have talked about substituting tariff revenue for income taxes. If so, that would mean keeping the tariffs in place even if countries like Canada and Mexico agreed to Trump’s demands on other issues, such as immigration restrictions.

Perhaps the biggest difference is the economic backdrop Trump must contend with this time.

Six years ago, inflation was low — maybe even too low, the Federal Reserve fretted. Trump’s first-term tariffs didn’t make a dent.

Inflation isn’t so benign anymore. Prices surged in the unexpected boom that followed the end of COVID-19 lockdowns. Inflation has come down from the four-decade high it hit in mid-2022, but it’s still stuck above the Fed’s 2% target and hasn’t shown much improvement since summer.

Trump’s tariffs could rekindle the inflationary trend and convince the Fed to cancel or postpone the two interest rate cuts it had anticipated this year. That would risk keeping “interest rates at their current elevated level for a longer period in 2025. That will push up mortgage and loan borrowing rates … and reduce real growth,’’ said Boston College economist Brian Bethune.

Outside a Harris Teeter supermarket near downtown Raleigh, North Carolina, Jacobs Ogadi had in his shopping bag an avocado, which almost certainly came from Mexico.

The 62-year-old mechanic said it “doesn’t take a rocket scientist’’ to know that Trump’s tariffs run counter to his promises to rein in inflation. “If it goes up 25%, it’s not the government, it’s not the Mexican people paying for it,’’ he said. “Who pays for it? Us.’’

AP