Estimated reading time: 4 minutes

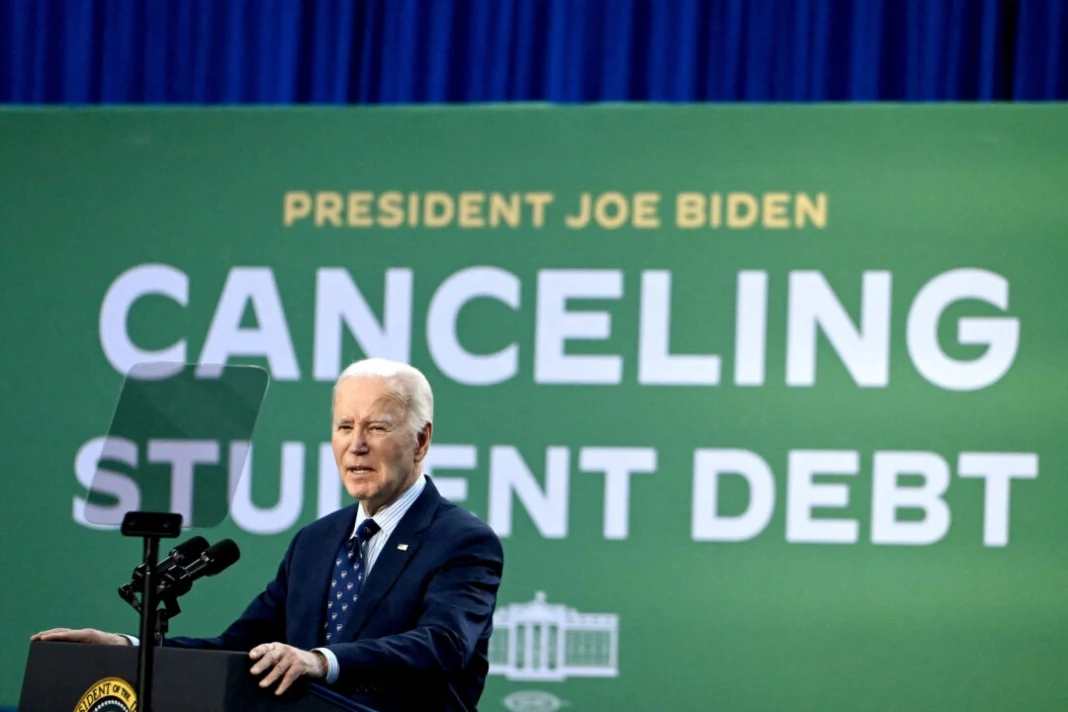

The Trump administration is moving to dismantle the federal student loan repayment plan known as SAVE, the last remnant of the Biden-era effort to provide large-scale student debt relief.

The U.S. Department of Education announced on Dec. 9 that it had reached a proposed settlement with Missouri and six other Republican-led states that sued to block the SAVE plan. The plan still needs approval from the U.S. District Court of the Eastern District of Missouri’s Eastern Division.

The states argued that the Biden administration exceeded its authority when it created SAVE in 2023, a program that offered millions of borrowers lower monthly payments and an accelerated path to debt erasure.

SAVE, described by the Biden administration as the “most affordable repayment plan ever,” allowed borrowers who originally took out $12,000 or less to have their debts forgiven after 10 years of qualifying payments. It also calculated monthly bills based on a small percentage of a borrower’s income, reducing payments to as low as zero dollars for millions.

Since its debut, the plan had canceled $1.2 billion in federal student loan debt owed by more than 150,000 borrowers. That relief ended in spring 2024 when a federal district court intervened to halt further debt discharges.

The SAVE program was introduced after the U.S. Supreme Court shot down President Joe Biden’s original mass-debt-cancellation plan, which relied on the post-9/11 HEROES Act that allows the education secretary to modify student loan-related rules during war or national emergencies.

SAVE instead drew its authority from a different statute, but the seven states argued that it was another attempt at broad debt cancellation that the Supreme Court had already forbidden.

The SAVE plan “is not the product of a well-reasoned decision,” their complaint read. “It is a pretext to evade a Supreme Court decision.”

In July 2024, the Eighth Circuit Court of Appeals affirmed the district court’s order and blocked the SAVE plan in its entirety. As a result, borrowers enrolled in SAVE were placed into an interest-free forbearance, where they have remained for a year.

On Feb. 18, the Eighth Circuit issued its long-awaited final decision, again siding with the suing states. The ruling not only continued to block SAVE but also prevented the Trump administration from processing forgiveness for borrowers enrolled in older, income-driven repayment plans.

As of July, the Education Department had identified more than 7.6 million borrowers in SAVE-related forbearance.

Under the proposed Dec. 9 settlement, the Education Department would stop enrolling any new borrowers into SAVE, reject all pending SAVE applications, and move all current SAVE borrowers into legally authorized repayment plans.

If the terms are approved by the court, roughly 7 million borrowers will have a limited window to select a different repayment plan and resume payments.

The Education Department hailed the settlement, which it said would mark a “definitive end” of the Biden administration’s student loan relief agenda.

“The law is clear: If you take out a loan, you must pay it back,” Under Secretary of Education Nicholas Kent said in a statement, arguing that Biden-era practices unfairly forced taxpayers, including those who did not go to college, to shoulder other people’s higher-education costs.

“Thanks to the State of Missouri and other states fighting against this egregious federal overreach, American taxpayers can now rest assured they will no longer be forced to serve as collateral for illegal and irresponsible student loan policies,” Kent said.

The states involved in the settlement are Missouri, Arkansas, Florida, Georgia, North Dakota, Ohio, and Oklahoma. Missouri also played a crucial part in the Supreme Court case that struck down Biden’s original debt-cancellation plan.

In that legal battle, Missouri made the case that forgiveness would reduce revenue for the Higher Education Loan Authority of the State of Missouri (MOHELA), a federal loan servicer that oversees 7.7 million accounts. Because MOHELA is a state-created entity, Missouri argued that harm to MOHELA constitutes harm to the state itself, a key argument that secured legal standing.

The Missouri-led lawsuit was filed less than a month after a separate coalition of 11 Republican-led states took legal action against SAVE, making similar arguments that neither the president nor the Education Department has the authority to turn loan repayment into what resembles a grant program.

Some states also claimed they would lose tax revenue under SAVE. (Theepochtimes.com)